-

Address: China, Shenzhen

-

Email: info@chinaglobalhub.com

China Global Hub

China business solutions center

-

Phone: +86 188 0760 4383

-

Telegram: @china_global_hub

China Global Hub

China business solutions center

Export to China 2025: strategies, cases and recommendations

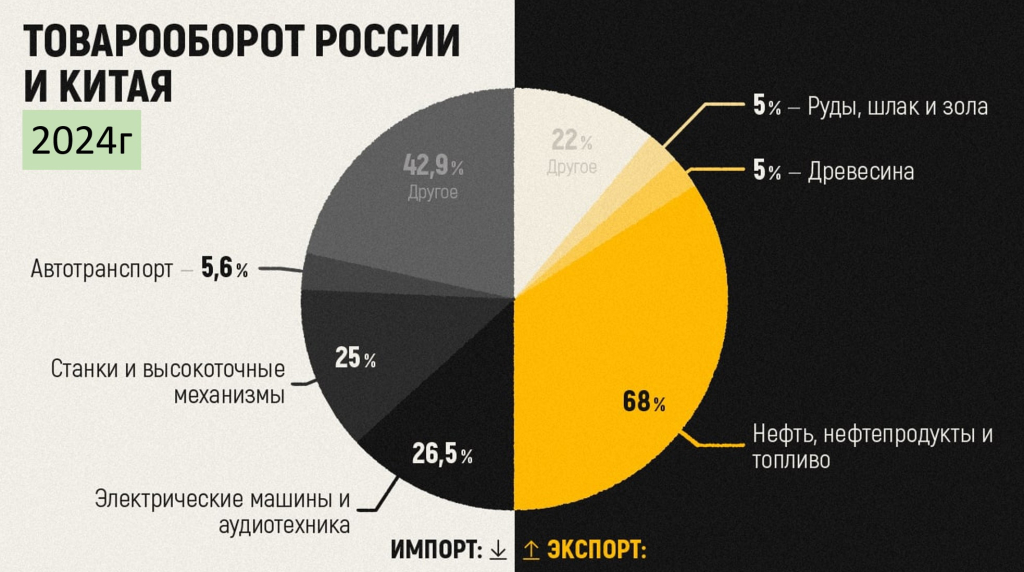

Export to China 2025 continues to be a priority direction for Russian business. Despite a decrease in trade turnover at the beginning of the year, certain industries, such as the agro-industrial complex and anthracite supplies, show stable growth. Russian companies are actively adapting their products for the Chinese market and developing long-term strategies to secure success.